Today, we’re going to look at perhaps the most misunderstood or mysterious of the Major Financial Reports – the Statement of Cash Flow.

“Cash Flow” at the most basic level is the movement of money in and out of an organization – in this case, your church. If the amount of cash goes up, you have a positive cash flow. If the amount of cash you have goes down, you have a negative cash flow. Churches with a recurring positive cash flow can fund their future vision, those with recurring negative cash flow cannot.

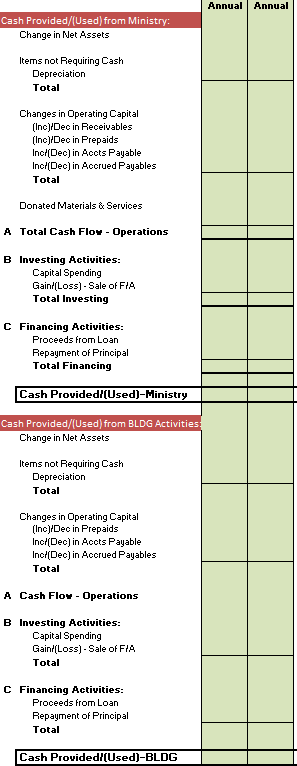

There are 3 things the Statement of Cash Flow provides – Cash Flow from:

1. Operating Activities

2. Investing Activities

3. Financing Activities…

and of course, the total. (ok, so 4 things)

This report is where all cash in/out comes together. The Income Statement does not capture all the in/outs of cash. That has to do with classification of certain financial transactions. In the most simplest of terms, transactions classified as Assets or Liabilities do not impact the Income Statement. They impact the Balance Sheet.

This is why it’s critical to look at and understand the Statement of Cash Flow.

Basics Mechanics of the Cash Flow Report:

1. Operating – this section converts the Net Assets/P&L from the Income Statement to a cash basis by subtracting expenses that do not use cash (like depreciation). The rest of this section is devoted to converting accrual accounting to cash. If you’re not generating sufficient positive cash flow from operations (ministry), you won’t be able to fund the Vision of your church in the time frame you desire. You won’t have cash for the next area as well.

2. Investing – this section shows anything related to the acquisition (or sale/disposal) of Long-Term Assets. Capital expenditures are the most common. Again, these transactions are on the balance sheet.

3. Financing – this section shows all cash in/out related to – you guessed it – Financing. This typically includes things like the principal portion of debt and capital lease payments. Money received from a loan are included here as well. Again, these transactions are on the balance sheet. (the interest portion of debt/lease payments are on the income statement however).

Again, the above are the most common transactions for most churches. That being said, some churches may have transactions not listed above that require significant judgement. Consult FASB 117 and Accounting Standards Codification 230.

That’s it. As a Pastor or member of the Finance Team, this report helps provide understanding of your church’s cash flow so you can make informed decisions. Understanding facilitates Clarity, which enables Pastor to better communicate Vision.

Download a sample [download id=”2291″]

See my next post in this series – The Budget to Actual Report.