The Balance Sheet or Statement of Financial Position is perhaps not as well understood by church leaders relative to the Income/Expense Statement. But these two are absolutely essential – and inextricably linked to each other.

Last week, we covered the Income Statement for The Executive & Finance Teams. [see that post here]

So, what is the Statement of Financial Position?

It’s a report comprised of 3 components – Assets (what is owned, prioritized by liquidity) , Liabilities (what is owed to others) and Net Assets (or Book Value of the Organization). Assets minus Liabilities = Net Assets.

So, on the one hand – you see a snapshot of the Financial Position of the church at any given point in time – which is the status of the three main components and their relationship to one another.

On the other hand, from a macro standpoint, it’s all about Liquidity – a measure of the church’s ability to meet its immediate and upcoming (short term) obligations. (One reason why accrual accounting is so important- all incurred but unpaid liabilities are on the books).

Looking at the Financial Position over an extended period of time reveals trends and therefore areas of improvement (whether in areas of scarcity or too much abundance).

It’s critical the Executive Team (or Solo Pastor) and the Finance Team understand the Statement of Financial Position, its components and each line item within.

As such, the Finance Person’s role is to:

a. Run a tight ship in terms of having well documented, supported and reconciled Balance Sheet accounts

b. Articulate what’s in each Balance Sheet line item to Leadership

c. Develop metrics that work for your leadership team in understanding Financial Position

d. Direct Leadership’s attention to areas that are either trending the wrong way or already are of concern

Lastly, to understand the changes month to month and from the prior year.

As to metrics mentioned above, here are a few to consider:

Cash:

Weeks of Operating Cash, Including Op Cash Reserves

Weeks of Other Reserves – like Internally Designated Funds (see my post on reserves)

Weeks of Note Reserves – if the church is in debt

Ability to meet obligations:

Current Ratio – measures ability to meet short-term obligations on time. I like to convert it to Weeks of Net Op Cash. (“Net” meaning Op Cash less Unrestricted Liabilities). This yields the # of weeks of cash on hand that is not “committed”.

Days in Accounts Payable (AP) – this is an indicator of whether bills are being paid on time. There’s a high-level calculation based solely on the Balance Sheet and Cash Expenditures found on the Inc/Exp Statement, but I prefer to calculate based on the unpaid invoices in Open AP each period end. It’s much easier for Pastor and Finance Team to understand.

Debt/Value Measurements:

I like the Loan to Value (appraised) – if for no other reason, your lender is tracking it. This percentage needs to be decreasing over time and will as long as debt payments are being made and assuming a real estate market that’s NOT in decline.

Loan to Book Value – this is really the same as above except you track the relationship of the loan balance to the Net Property & Equipment value on your books. Without getting into a lot of accounting techno-jumbo, these should be kinda close to the appraised value. If the appraised value is significantly less than your book value, then a write-down may be in order.

Debt Service Coverage Ratio – if the church has debt, this should be tracked periodically as the lender is watching/calculating it – you don’t want this going in the wrong direction leading up to loan renewal, for example.

Change in Debt – Although, this is easily seen on the Statement of Cash Flow, it can be included here as it’s an indicator if the note payments are being made as expected.

Reporting Strategy:

Obviously, since the overall Financial Condition of the church rests with these two teams, they should get the detailed version of the Balance Sheet. I’d suggest all others get a summarized version or selected components.

Bottom Line:

To the extent Pastor understands where the church stands in regards to the church’s money (in this case, its Financial Position), Pastor can cast vision with greater clarity. The congregation will respond positively because they trust the Pastor and Finance Leaders to know and manage their church’s financial position.

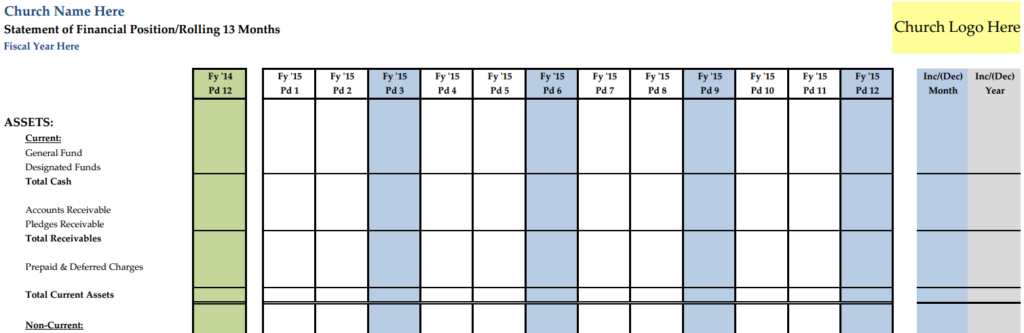

Download this Balance Sheet pdf as food for thought [download id=”1019″]

Now, let’s look at the Cash Flow report.