Does your church need to have cash reserves?

Rest assured. It does.

5 Reasons Why:

1. To Sustain the Present

2. To Fund the Future Vision

3. To enable taking advantage of a ministry or missions opportunity

4. To guard against being broke

5. It’s a good model of stewardship

At the end of the day, the reality is, you’ll fund your needs from the budget or reserves – or it won’t get done.

If you don’t have any reserves, then you’re operating week to week, hand to mouth.

So hopefully by now you see cash reserves are useful.

The question then becomes “How Much is Needed?” There’s no hard/fast rule here, no right or wrong…only what works in your own context given the church’s needs, goals and financial resources.

I. Sustain the Present by having these reserves:

1. Operating/Budget Reserve

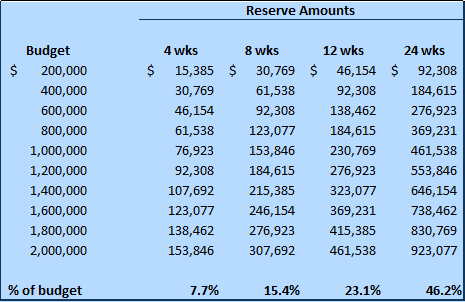

You need 1 month of budgeted income on hand at a minimum. I’ve seen a lot of people and organizations in the church world say that 6 months is ideal. This may be ideal in the personal finance world, but to me 6 months is a bit too much for the church. 6 months in personal funds is guarding against job loss (no income coming in) so you could live for 6 months (time to find another job). The reserve here is not meant to cover the church for 6 months with ZERO income. I tend to think 4 to 8 weeks is the range to fall within. Still it’s your call as to how much is enough for your church.

This table gives you an idea of how much the reserve would be based upon the budget size of your church:

Additional things to consider in determining how many weeks you need:

a. How severe the summer slump in giving is

b. Weather related Sundays typically missed

c. Donor(s) that gives 10% of more of the total budget

2. Reserve for Repairs and Maintenance

You’ll need to set aside funds for when unexpected/major repairs are needed – HVAC systems, A/V, Roof, Parking Lot, Kitchen Equip, Plumbing etc. There’s a church in my area that can’t meet in their sanctuary right now because it can’t afford the repairs, so it meets in the gym.

The amount needed will be based upon the age & condition of the building & equipment. One way to think about this is – ask what is the most expensive thing that could need replacing (as worse case) that would have a negative impact – and have that amount in reserve as your minimum. (Personally, I’d take that and multiply by two). Let’s say one of the air handlers in the sanctuary were to go out and to replace it would be $20,000. You need $20,000 to $40,000 in reserve.

You also need to give consideration to the planned replacement of certain things such as carpeting, sanctuary seating, the roof, A/V/L upgrades as so on. You can have a separate reserve for this or just include in R&M. Just keep an eye on systems and structures and ideally have this money set aside in advance of the planned replacement.

3. Reserve for Note Payments

You need 1 to 3 months of your note payment on hand to cover shortages in offerings especially if the note payment is not in the budget. I’d still have a separate reserve even if it is in the budget. You can’t afford to miss a payment and you don’t want to pull from other ongoing ministries just to make the payment.

Something worth noting: some lending institutions require the church to adhere to certain conditions in a loan covenant. In this case, dictating the level of reserves. Fall below these levels and could be in default. Avoid loan covenants if you can.

Ideally, the reserves above need to be in place (or well on their way) before you start setting dollars aside for Vision Related needs.

II. Funding the Future Vision

Ideally, depending on your 1-3 year vision/strategy, set aside funds needed for these items to come to fruition.

Given how much your top line revenue is growing (and other factors), you may want to have these fully funded before launching – or have a portion funded in advance.

These can be any number of things and can vary greatly church to church based upon the God-given vision/strategy for your church, such as:

>launching a new ministry or mission

>breaking ground on a new building – build on cash or have large “downpayment” ready

>renovating existing structures

>expanding parking

>starting a campus across town

>planting another church

Perhaps the vision for now is to rid yourself of existing debt. Then use all funds in excess of budget requirements (including the sustain the present reserves) to pay down debt.

Now, if the church is not generating any margin to fund reserves, take a look at these margin planning posts:

1. Planning for Margin, Part 1

2. Planning for Margin, Part 2

3. Margin Planning Model

Lastly, Communicate to the Staff AND the Church:

It’s helpful to articulate the why of reserves, when they’ll be used and how you’re setting funds aside (% of giving, % of budget, fixed $ amount).

Communicate how much has been deemed enough by leadership for each reserve fund. (Dollar amounts, weeks/months on hand or a % of budget).

Communicate what happens when reserve goals are met. Will you stop funding (stays in Gen Fund), or will the excess go to debt, or will it go to Long Term Vision Plans, etc.

In closing:

The main thing is to get these reserves in place. You don’t have to get there overnight…just set a plan in motion.

I know, there’s a tension to balance here between trusting the Lord to provide and doing your part by prudent planning. Pray, seek counsel and the Lord will lead. Follow His lead.